NetAsset by Netgain

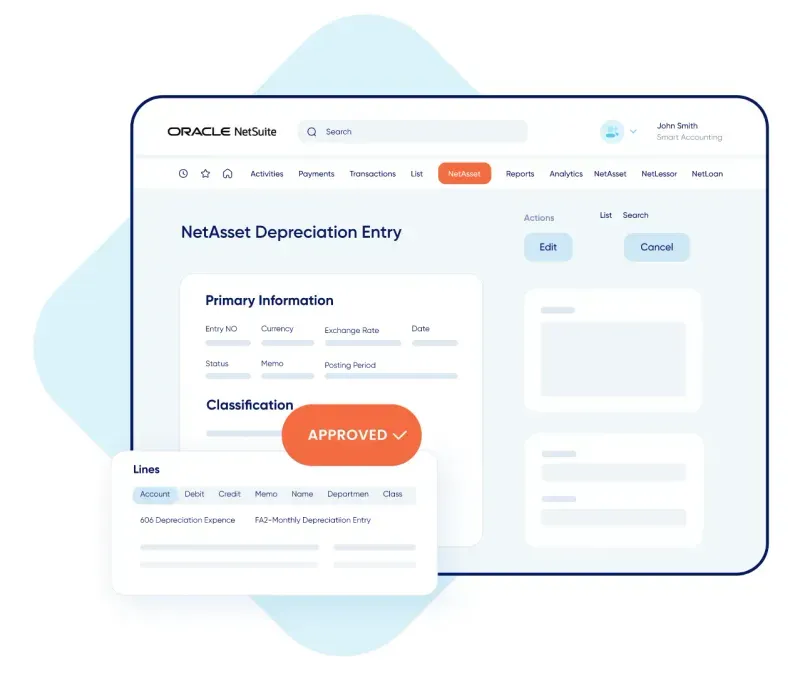

Otomatisasi dan Optimalkan Pengelolaan Aset Tetap di NetSuite

NetAsset dari Netgain menyederhanakan pengelolaan aset tetap dan memperjelas jejak audit, memungkinkan tim akuntansi untuk memusatkan pelacakan aset, mengotomatisasi jadwal penyusutan, dan memastikan pelaporan keuangan yang akurat.

Fitur Unggulan

Jadwal dan metode penyusutan otomatis

Laporan roll-forward dan bertingkat untuk aset tetap

Pelacakan aset dan pengelolaan siklus hidup terpusat

Pelaporan keuangan siap audit

Integrasi native NetSuite untuk alur kerja yang lancar

Jelajahi NetAsset

Temukan cara mengelola aset tetap dengan mudah langsung di dalam NetSuite. Pantau, hitung penyusutan, dan buat laporan dengan akurat dan efisien—semuanya dalam satu platform.

Keunggulan Menggunakan NetAsset

Otomatisasi Penyusutan

Sederhanakan perhitungan kompleks dengan metode penyusutan yang dapat disesuaikan.

Sentralisasi Pengelolaan Aset

Lacak dan kelola aset tetap langsung di dalam NetSuite.

Tingkatkan Pelaporan

Hasilkan laporan bertingkat dan roll-forward untuk peramalan dan audit yang akurat.

Pastikan Kepatuhan

Tetap patuh pada standar akuntansi seperti ASC 842 dan IFRS 16.

Integrasi Tanpa Hambatan

Dikembangkan untuk NetSuite, NetAsset memastikan implementasi mudah dan fungsionalitas yang ramah pengguna.

Mengapa Memilih Netgain?

Sebagai produk yang dikembangkan oleh akuntan profesional bersertifikasi yang sebelumnya bekerja di empat besar Deloitte, PwC, EY & KPMG – Netgain benar-benar memahami tantangan yang dihadapi tim keuangan, serta keterbatasan perangkat lunak akuntansi tradisional.

Selain itu, Netgain adalah Suite App yang dibangun sebagai mitra bersertifikasi dalam NetSuite SuiteCloud Developer Network (SDN). Solusi ini memfasilitasi penutupan buku tanpa hambatan melalui otomatisasi end-to-end untuk proses keuangan utama. Bukti kualitas Netgain sebagai produk tercermin dari tingkat retensi pelanggan sebesar 98%.

Talk to Our Experts

Lead Netgain

This form is created for lead netgain

"*" indicates required fields