Oracle NetSuite Accounts Receivable

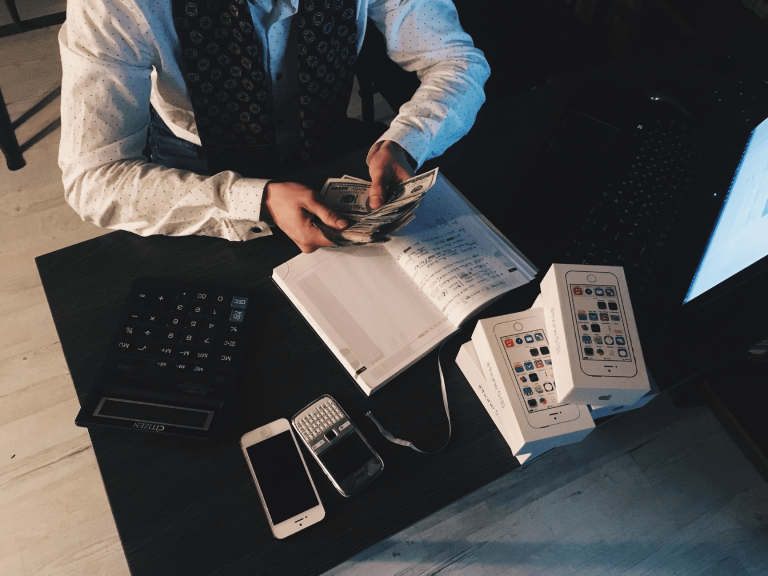

AR is a crucial component of managing cash flow. Understanding a company's cash flow and overall financial health requires accurate accounts receivable records.

Our Customers

After billing, customers pay your business in accounts receivable. Non-paying customers can hurt cash flow, loan applications, and investor interest. An account receivable may lose value if a customer pays late.

Oracle NetSuite automates accounts receivable management. This speeds payments and detects declining accounts receivable cash flow, enabling companies to invoice and collect payments quickly. It shows accounting teams what’s happening and what needs their attention. Oracle NetSuite improves AR productivity, centralisation, and flexibility. Configurable dashboards show KPIs and purchase orders. This aids the organisation and prevents late payments.

Apply For The Enterprise Development Grant (EDG) And Digitise Your Business With Oracle NetSuite Cloud ERP

Why Oracle NetSuite Accounts Receivable?

- Accelerate Cash Flow

- Seize New Investment Opportunities

- Real-Time Visibility

- Delivers The Insights

- End-To-End Accounting Solution

- Reduce The Need For Additional Headcount

- Eliminate Manual Processes

- Accurate And Timely Financial Reports

- Ensure Tax Compliance

- Gain Efficiencies

Features of

Oracle NetSuite Accounts Receivable

NetSuite Inventory Management minimizes manual processes by automatically tracking inventory levels, orders and sales throughout the inventory life cycle, and provides clear visibility into any inventory liabilities.

Optimise your cash flows by automating accounts receivable

Customer Success Story

Why Choose PointStar Consulting

Talk to Our Oracle NetSuite Experts

Lead Generation

This form is created for lead generation.

"*" indicates required fields